Discretionary FX Macro & Micro

Our flagship strategy analyzing fundamental macroeconomic trends to identify investable opportunities in G10 currencies. We augment this with technical analysis to time entry and exit strategies.

- Max 5% capital risk per trade

- 1:2 Risk to Reward Ratio

- Highly liquid portfolio

- Monthly losses capped at 3%

Asset Classes

Diversified Investment Portfolio

Stock Market

Algorithmic and discretionary trading in global equity markets focused on blue-chip and high-growth potential sectors. Our active management keeps the portfolio fresh and aligned with market conditions.

Strategy

Global thematic equity allocation with technical overlays

Risk Profile

Moderate with defined stop losses

Horizon

Medium to long-term with active rebalancing

Gold & Commodities

A critical hedge against currency devaluation and inflation. Our macro strategy identifies key rebalancing mechanisms in the global market to time gold and precious metal entries.

Strategy

Macro-driven physical and ETF exposure

Risk Profile

Low to moderate with high liquidity

Horizon

Long-term value storage and inflation hedge

Real Estate

Diversify into tangible assets. We analyze property markets to identify high-yield commercial and residential opportunities with strong fundamentals and cash flow potential.

Strategy

Commercial and residential income-producing properties

Risk Profile

Moderate with tangible asset backing

Horizon

Long-term appreciation and cash flow

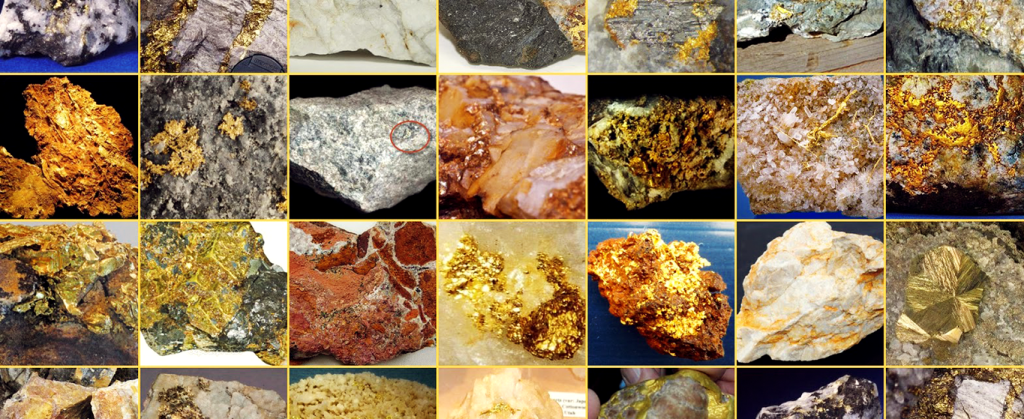

Solid Minerals

Strategic investments in industrial minerals critical for technology and manufacturing sectors globally. Low correlation to traditional markets provides excellent diversification.

Strategy

Industrial minerals for tech and manufacturing

Risk Profile

Moderate with supply-demand dynamics

Horizon

Long-term structural demand growth

Precious Stones

Alternative asset allocation in high-value gemstones for long-term value storage and capital appreciation with tangible security and portability.

Strategy

High-grade diamonds and colored gemstones

Risk Profile

Low with stable long-term appreciation

Horizon

Long-term value preservation

Cannabis Industry

Emerging market opportunities in medicinal and legal recreational cannabis sectors across regulated jurisdictions worldwide. High growth potential with managed volatility.

Strategy

Regulated markets with growth potential

Risk Profile

High growth with bounded risk controls

Horizon

Medium to long-term sector expansion

Investment Plans

Choose Your Path to Financial Growth

Select an investment plan that aligns with your financial goals and risk tolerance. All plans feature daily returns and flexible durations.

Starter Plan

Perfect for beginners

- Low-risk diversified portfolio

- Monthly performance reports

- 24/7 customer support

Advance Plan

For growing investors

- Moderate-risk balanced portfolio

- Weekly performance updates

- Dedicated account manager

Premium Plan

Enhanced returns

- Aggressive growth portfolio

- Real-time portfolio tracking

- Priority customer support

- Quarterly strategy sessions

Milestone Plan

Achieve major goals

- Premium diversified assets

- Custom portfolio strategy

- Senior account manager

- Monthly video consultations

Pro Plan

Professional grade

- Institutional-grade strategies

- Direct access to fund managers

- Exclusive investment opportunities

- Bi-weekly strategy reviews

Whales Plan

Ultra high net worth

- Bespoke portfolio architecture

- Private equity & hedge fund access

- Dedicated wealth management team

- White-glove concierge service

- 24/7 direct line to portfolio managers

All investment plans are subject to market conditions and regulatory compliance. Past performance does not guarantee future results. Daily returns are estimates based on historical data and may vary. Please consult with our investment advisors before making any investment decisions.

Ready to Diversify Your Portfolio?

Contact us to discuss which investment strategies align with your financial goals.

Schedule Consultation